Small and medium enterprises (SMEs) are the backbone of Oman’s industrial economy, playing a vital role in job creation, innovation, and sector diversification. As demand for skilled services and specialized production grows, many SMEs are looking to expand by establishing or upgrading industrial workshops, particularly in high-potential hubs like Sandan City. However, the cost of industrial fit-outs—from machinery to ventilation systems, flooring to custom layouts—can be a major financial barrier for many new and growing businesses.

This is where smart funding options come into play. SME workshop financing in Oman is not just about accessing capital—it’s about enabling growth, compliance, and competitiveness. Whether you’re an automotive repair business, logistics support provider, or small-scale manufacturer, the right financing plan can help you build an efficient, regulation-ready workspace without draining your working capital.

In this blog, we’ll explore the full spectrum of SME workshop financing opportunities in Oman—from government grants and bank loans to Islamic finance and leasing models. We’ll also look at why Sandan City is emerging as a top location for SMEs seeking affordable space, support infrastructure, and financial guidance tailored to industrial fit-outs.

Why SMEs in Oman Are Investing in Industrial Fit-Outs

#1 Expanding Sectors Drive Infrastructure Demand

Oman’s SME ecosystem is rapidly evolving, especially in key sectors like logistics, automotive services, food processing, and light manufacturing. As market opportunities expand, businesses must scale operations with fully functional, compliant, and customer-ready workshop spaces. From vehicle diagnostics to precision fabrication, these operations demand purpose-built environments, making industrial fit-outs more important than ever.

#2 Customer Expectations and Regulatory Compliance

Today’s customers expect clean, well-organized, and efficient workshops, not makeshift facilities. Additionally, regulatory bodies in Oman are becoming more stringent with safety, environmental, and structural compliance. SMEs that aim to grow sustainably must meet these benchmarks, and this starts with the right workshop design. Investing in ventilation, fire safety systems, drainage, and electrical optimization is no longer optional—it’s essential.

This growing need has also pushed demand for SME workshop financing in Oman, as business owners seek practical ways to fund such upgrades without freezing their working capital.

#3 Industrial Parks Enable Faster, Smarter Growth

Industrial zones like Sandan are responding to this demand with pre-zoned commercial plots, infrastructure-ready spaces, and business setup support. SMEs setting up workshops in such environments gain access to smoother permit processes, utility provisions, and co-location benefits. More importantly, many financing providers now recognize these parks as low-risk locations, making it easier for businesses to secure loans or lease equipment.

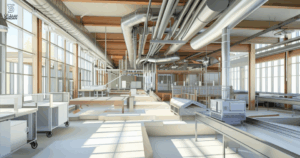

What Goes Into a Modern Industrial Fit-Out

A proper workshop fit-out can include:

- Epoxy flooring for safety and durability

- Industrial-grade ventilation and HVAC systems

- Compressed air lines and drainage

- Heavy machinery foundations

- Smart layouts to separate workflow zones

These aren’t minor expenses—they’re long-term investments in productivity, brand image, and compliance. For many, this is where SME workshop financing in Oman becomes critical in bridging the gap between vision and execution.

Common Financing Challenges Faced by SMEs

#1 Limited Collateral and Difficult Loan Approvals

One of the most pressing challenges for SMEs in Oman is the inability to offer sufficient collateral when applying for loans. Many new or small businesses rent their premises, own limited physical assets, and lack a long financial history. Traditional banks often require strong guarantees, which can be difficult to provide. This slows down or blocks access to crucial funds, especially for industrial projects like workshop fit-outs. Even when financing is available, the paperwork and processing time can be lengthy, stalling project timelines.

#2 High Interest Rates on Unsecured Loans

For those who do secure a loan without collateral, the trade-off often comes in the form of higher interest rates. These rates can make repayment difficult for SMEs operating on tight margins. The long-term burden reduces liquidity and leaves little room for reinvestment or operational flexibility, making even approved SME workshop financing in Oman less practical for some.

#3 Knowledge Gaps Around Financial Planning

A significant number of new entrepreneurs underestimate the complexity of funding large-scale workshop development. From not preparing detailed cash flow forecasts to overlooking equipment depreciation or licensing costs, these blind spots weaken funding applications. Limited financial literacy also leads to poor negotiation with lenders or misunderstandings around repayment structures, increasing the risk of defaults or mismatched funding.

#4 Mismatch Between Business Stage and Loan Products

Another hurdle is the disconnect between what banks offer and what SMEs actually need. Early-stage businesses may require small, short-term loans to get their workshops operational. However, many available products are geared toward mature businesses or long-term projects. This misalignment leads to rejections or the wrong type of financing being applied.

For this reason, tailored and accessible SME workshop financing Oman solutions—especially those aligned with the business lifecycle—are crucial for enabling sustainable industrial growth in the country.

Overview of SME Workshop Financing in Oman

What Is Considered Workshop Financing?

When we talk about SME workshop financing in Oman, it refers to financial products specifically tailored to support the setup, renovation, or expansion of industrial workshops. This includes:

- Fit-Out Costs: Construction, flooring, ventilation systems, partitions, lighting, and safety compliance elements.

- Machinery & Equipment: Welding systems, lifts, compressors, diagnostic tools, and storage racks.

- Working Capital: Funds to cover upfront labor, permit fees, utility deposits, and initial operational expenses.

In short, any expense directly tied to the development or upgrade of a functional industrial workspace can fall under this financing umbrella.

Who Offers Workshop Financing in Oman?

Several institutions provide SME-focused funding in Oman, including:

#1 Commercial Banks

Major banks like Bank Muscat, NBO, and Bank Dhofar offer SME loans that can be used for workshop development. These usually come with flexible repayment options, depending on the loan size and business profile.

#2 Islamic Finance Institutions

Sharia-compliant options like Ijarah (leasing) or Murabaha (cost-plus financing) are increasingly popular for equipment and fit-out funding.

#3 Government-Backed Programs

Oman Development Bank (ODB) and initiatives by MoCIIP or Invest Oman offer subsidized loans, lower interest rates, and business advisory services for qualifying SMEs.

Each provider has different criteria, but all generally aim to make SME workshop financing in Oman more accessible to small business owners looking to industrialize.

Loan Terms, Interest Rates & Eligibility

#1 Tenure

Most financing terms range between 2–7 years, depending on the size of the loan and the nature of the business.

#2 Interest Rates

Can range from 4%–9% annually for commercial loans. Government-supported financing may offer subsidized or deferred interest for the first year.

#3 Eligibility

Must be a registered SME under Oman’s commercial laws. Some banks require a minimum operational history (6–12 months), while others support startups with strong business plans.

#4 Documentation

Includes trade license, CR, detailed cost estimates, quotations for equipment or construction, lease agreements, and in some cases, audited financial statements.

With a growing ecosystem of banks, Islamic institutions, and development agencies, the landscape for SME workshop financing in Oman is becoming more inclusive and diversified, giving entrepreneurs multiple pathways to bring their industrial vision to life.

Government-Backed Financing Programs

To strengthen Oman’s industrial base and reduce barriers to entry, the government has introduced various financial initiatives designed to empower SMEs. These programs specifically cater to businesses needing infrastructure investment, making them a key driver of SME workshop financing in Oman.

#1 Oman Development Bank (ODB): Industrial Project Support

The Oman Development Bank remains one of the most active public financing bodies supporting industrial development. ODB provides specialized loans for SMEs planning to set up or expand workshops in sectors such as manufacturing, automotive services, and logistics.

Key features of ODB loans include:

- Low interest rates, often subsidized

- Flexible repayment periods of up to 10 years

- Grace periods (often up to 12 months) for new startups

- Support in project evaluation and technical feasibility

ODB’s industrial loan offerings can cover both fixed assets like machinery and civil works, making it ideal for entrepreneurs seeking comprehensive SME workshop financing in Oman.

#2 Al Raffd Fund and Emerging SME Initiatives

While the Al Raffd Fund was a major contributor to youth and SME entrepreneurship funding in Oman, its programs have since been integrated into newer government-led initiatives. Depending on the latest regulations, SMEs may now access similar benefits through unified business development portals or the Small and Medium Enterprises Development Authority (SMEDA).

These programs often provide small ticket loans, mentorship, and startup incubation—particularly for Omanis entering workshop-based industries like automotive repairs or equipment services.

#3 MoCIIP and Invest Oman: Enablers, Not Just Regulators

The Ministry of Commerce, Industry and Investment Promotion (MoCIIP) and Invest Oman play a growing role in facilitating access to funding. Beyond policy, they connect businesses to trusted financing partners, support feasibility assessments, and ensure alignment with Vision 2040 goals.

Why Government-Backed Loans Make a Difference?

These financing schemes are designed to de-risk industrial entrepreneurship. With benefits like low interest, delayed repayment, and embedded advisory support, they offer a reliable pathway for startups and micro-industries to pursue SME workshop financing in Oman with confidence and clarity.

Private Banks & Islamic Finance Options

Mainstream Bank Loans for SMEs

Oman’s leading commercial banks play a vital role in offering tailored financing options for SMEs. Institutions like Bank Muscat, National Bank of Oman (NBO), and Bank Dhofar offer business loans that can be used specifically for workshop fit-outs, equipment purchases, and operational expansion. These banks have dedicated SME departments that understand the unique challenges of small businesses and offer support accordingly.

Loan terms generally include:

- Financing amounts starting from OMR 5,000 to OMR 250,000

- Tenures ranging from 2 to 7 years

- Interest rates that vary between 6% to 9%, depending on credit evaluation

- Optional grace periods for startups or newly established SMEs

These structured products make it feasible for entrepreneurs to secure SME workshop financing in Oman for both new and expanding ventures.

Islamic Finance: Sharia-Compliant Alternatives

For SMEs seeking ethical and interest-free financial solutions, Islamic finance institutions offer models such as:

- Ijarah: An operating lease where the bank owns the equipment or workshop fit-out materials and leases them to the SME.

- Murabaha: A cost-plus financing model where the bank buys the required equipment and sells it to the SME at an agreed-upon markup.

These options are particularly attractive to entrepreneurs who prefer asset-based transactions over cash loans, and they also help reduce financial risk by aligning repayments with business performance.

Application Process and Documentation

Whether applying for conventional or Islamic finance, SMEs typically need to submit:

- Valid Commercial Registration (CR)

- A well-prepared business plan or fit-out proposal

- Bank statements (past 6–12 months, if applicable)

- Quotations for workshop equipment or construction work

- Tenancy agreements (especially for locations like Sandan)

The approval process usually takes between 2 to 4 weeks, depending on the institution and the quality of documentation submitted.

Real-World Financing Scenario

For example, an automotive repair SME in Sandan City may apply for a Murabaha loan of OMR 50,000 to cover ventilation systems, epoxy flooring, and machinery. With repayment structured over five years, the monthly payments remain manageable, while the business can begin operations without depleting cash reserves.

Such practical, flexible options make private banking a key component in enabling SME workshop financing in Oman across industries.

Leasing vs. Financing Fit-Out Equipment

Understanding the Difference

When setting up a workshop, SMEs often face a major decision: should they lease or finance their fit-out equipment? Both options fall under the broader umbrella of SME workshop financing in Oman, but the right choice depends on budget, growth plans, and operational flexibility.

Leasing allows businesses to use equipment—such as compressors, lifts, and air filtration systems—without owning them outright. Instead, they pay a monthly or quarterly fee over an agreed period.

Financing, on the other hand, involves purchasing the equipment with loaned capital and repaying it in installments, leading to full ownership.

When Leasing Makes More Sense

Leasing is particularly beneficial for startups in Sandan and similar industrial zones when:

- Cash flow is limited, and upfront ownership isn’t financially viable.

- Equipment is likely to become outdated, making upgrades necessary.

- The business needs time to test operations before committing to full-scale purchases.

Additionally, leasing often includes maintenance support, which reduces operational headaches for small teams.

Tax, Flexibility, and Upgrade Considerations

Leased equipment is generally treated as an operational expense, which may offer favorable tax treatment. Leasing also provides more flexibility in contract duration and replacement cycles. Conversely, financing provides ownership benefits and long-term value but may restrict liquidity in the early stages.

Leasing vs. Financing: Quick Comparison

| Feature | Leasing | Financing |

| Ownership | No | Yes |

| Upfront Cost | Low | Moderate to High |

| Flexibility | High | Medium |

| Maintenance | Often included | At the owner’s cost |

| Upgrade Potential | Easier | Limited |

Tips for SMEs Applying for Financing

Tip 1. Build a Strong Business and Cash Flow Plan

Lenders want to know that your business is sustainable and your repayment plan is realistic. Before applying for any SME workshop financing Oman package, prepare a detailed business plan that outlines your revenue projections, customer pipeline, workshop operations, and expenses. Support this with a robust cash flow forecast to demonstrate how you’ll manage repayments over time.

Tip 2. Know Your Numbers: Break Down Fit-Out Costs

Being vague about expenses can delay or reduce your financing approval. Break down your fit-out needs into clear categories: flooring, insulation, machinery, HVAC, lighting, and safety systems. Attach vendor quotations and installation timelines. This level of detail builds lender confidence and helps you request the exact funding required—neither too little nor too much.

Tip 3. Secure Pre-Approvals Before Committing

Avoid signing lease agreements or contractor contracts until you’ve received financing pre-approvals. This gives you the flexibility to negotiate terms and timelines based on real funding, rather than assumptions. Many SMEs rush into a physical setup only to face capital shortages midway—an issue easily avoided with early loan validation.

Tip 4. Work with Industry-Specific Consultants

Financing industrial workshops isn’t the same as applying for a retail or service-sector loan. Work with consultants or financial advisors who understand SME workshop financing in Oman, including Islamic finance options, grant schemes, and bank lending protocols. Their insights can save you time, improve your proposal, and help you access better terms.

Why Sandan City Attracts SME Investors?

For small and medium businesses, every Omani Rial counts. Sandan City combines cost efficiency, fit-out readiness, and regulatory ease, making it the perfect environment for businesses seeking structured and scalable SME workshop financing in Oman. Its tailored support system reduces the financial burden while empowering long-term industrial growth, turning workshop dreams into operational realities.

#1 Affordable, Flexible Spaces for Industrial Growth

Sandan City, strategically located near Muscat, has emerged as a magnet for SMEs looking to scale operations without overspending on real estate. What sets Sandan apart is its wide range of affordable industrial plots and pre-built units that are designed with flexibility in mind. Whether an SME needs to install heavy machinery, create custom floor layouts, or integrate specific ventilation systems, the infrastructure readily supports such modifications, making it ideal for workshop fit-outs at any scale.

#2 Permit and Business Setup Assistance

Navigating the regulatory landscape can be a challenge for small businesses. Sandan offers in-house business support services, helping SMEs handle paperwork related to licensing, construction permits, environmental approvals, and lease registration. This reduces both the time and cost involved in setup, two major factors in the viability of SME workshop financing in Oman.

#3 On-Site Financing and Leasing Ecosystem

Another major advantage of Sandan is the presence of on-site banks, leasing agencies, and financial consultants. Entrepreneurs can explore Islamic financing, short-term leases, or government loan coordination without stepping out of the industrial park. Having access to both funding and physical infrastructure in one location simplifies decision-making and accelerates execution.

FAQs

What qualifies as a workshop under SME financing schemes in Oman?

A workshop typically refers to an industrial or commercial space used for activities such as automotive services, equipment repair, light manufacturing, or fabrication. To qualify for SME workshop financing in Oman, the space must be legally registered and the activity must align with permitted industrial or commercial use in zones like Sandan or other approved parks.

Can new startups with no credit history apply for SME workshop financing?

Yes, several banks and government-backed programs in Oman support startups. While traditional banks may require operational history, institutions like Oman Development Bank and some Islamic lenders assess feasibility based on your business plan, projected cash flow, and asset value, offering support even without credit history.

What documents are required to apply for workshop financing in Oman?

Generally, you’ll need your commercial registration (CR), lease agreement or land documentation, a detailed business plan, equipment quotations, valid ID, and in some cases, bank statements or audited financials. Documentation varies slightly depending on the lender or program.

Is leasing workshop equipment a better option than taking a loan?

Leasing can be more flexible and cost-efficient in the short term, especially for startups or businesses that plan to upgrade equipment often. Loans, on the other hand, offer long-term value through ownership. The best option depends on your cash flow, growth strategy, and financial goals.

Are there industrial parks in Oman that help with both financing and setup?

Yes, Sandan Industrial Park is a prime example. It not only offers ready-to-use industrial spaces but also supports SMEs with permit processing, access to on-site banks, and connections to financing partners, making it a one-stop hub for SME workshop financing in Oman.

Conclusion

Oman’s growing industrial landscape is brimming with opportunities for SMEs looking to establish or expand workshops. From logistics and automotive services to light manufacturing, the demand for well-fitted, efficient industrial spaces is only rising. But setting up a workshop is capital-intensive, making the right financing route not just helpful, but essential.

Whether you choose to fund your fit-out through a government-backed scheme like Oman Development Bank, opt for Islamic financing, or approach a commercial bank for support, the options are increasingly accessible. Even leasing or hybrid models can offer viable alternatives depending on your growth stage and strategy. With robust infrastructure, regulatory support, and a thriving SME ecosystem, Oman—and especially industrial zones like Sandan—offers a compelling launchpad for industrial entrepreneurs.

Sandan City, in particular, simplifies the journey with affordable spaces, on-site financing partners, and end-to-end business support, making it the perfect destination for accessing SME workshop financing in Oman.

Ready to set up your workshop at Sandan?

Get in touch with our team to explore the best-fit financing options and secure your industrial future with confidence.